If “America” means wealthy corporations, foreign linked investors, billionaires who own football teams, and giant universities with massive endowments.

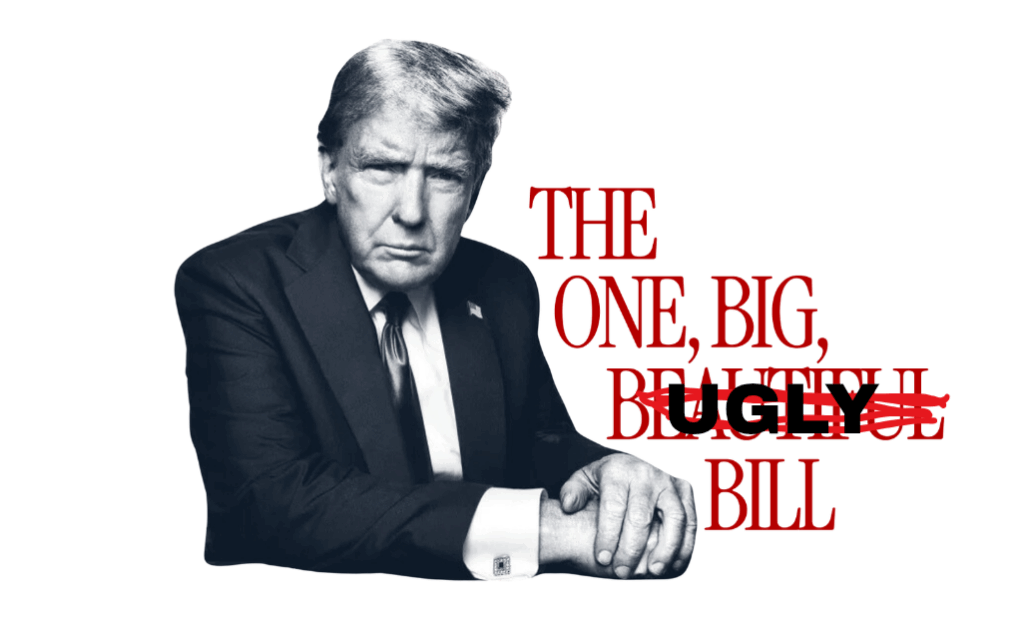

The-One-Big-Beautiful-Bill-Section-by-Section

Part 1: working families over elites

Translation: working families, move over. Elites coming through.

The following sections take a blowtorch to every green energy credit regular people could use to lower their energy bills or upgrade their homes. Meanwhile, billionaires and multinational corporations somehow receive new advantages and incentives.

112001: kill the used EV (electric vehicle credit)

Great news, rich people with brand new Teslas still do not need help. Bad news, middle class families who could only afford a used EV are told to figure it out.

112002: kill the new EV (electric vehicle credit)

The seven thousand five hundred dollar credit that helped reduce the cost of electric cars is gone. People buying a one hundred twenty thousand dollar electric Hummer were never using it anyway.

112003: kill the commercial EV (electric vehicle credit)

Electric delivery trucks and vans that help communities breathe cleaner air no longer get any credit. Billion dollar logistics companies will simply pass the cost onto consumers.

112004: kill the charging station credit

If you wanted more EV chargers in your neighborhood, too bad. We are returning to gas station domination. Exxon is pleased.

112005: kill the home energy efficiency credit

Better insulation, lower heating bills, lower electric bills. Congress responds with, let them freeze.

112006: kill the solar credit

Middle class families who installed solar panels will now pay full price. Oil companies remain heavily subsidized.

112007: kill energy efficient home construction credits

Builders trying to create greener and cheaper to maintain homes are stopped. Large mansions can remain wasteful in peace.

112008 through 112015: kill, shrink, and bury all clean energy incentives

Wind, solar, nuclear, hydrogen, and carbon capture, anything that could lower bills or reduce climate disasters, is escorted out the back door. Fossil fuel tax breaks remain untouched.

112016: give hydrogen storage and carbon capture companies a treat

Huge corporations transporting hydrogen or capturing carbon get more tax benefits. Regular Americans paying high utility bills get thoughts and prayers.

112017: slow down billionaire sports team tax write offs

Owners buying six billion dollar sports franchises must take their tax write offs a little slower. Not reduced, not removed, just slightly less ridiculous.

112018: limit salt deductions for high earners

Rich taxpayers still get deductions, only slightly smaller. They are perfectly fine.

112019: close an executive pay loophole

CEOs earning twenty million dollars a year might face a tiny inconvenience. The loophole is narrowed but the real advantage remains.

112020: tax nonprofits paying million dollar salaries

Large nonprofits that pay executives like Fortune 500 companies finally get checked. Small community nonprofits remain unaffected.

112021: tax billionaire universities

Elite universities with enormous endowments face a slight tax bump. They will recover by raising tuition again.

112022: higher taxes on private foundations

Wealthy families can still shelter billions in foundations, they will simply pay a slightly higher fee.

112023: foundation stock purchase schemes shut down

Foundations can no longer buy stock to help billionaire owners avoid taxes. A small victory for fairness.

112024: make nonprofits pay tax on certain perks

Nonprofits can no longer treat catered lunches and free parking as charity expenses. Reasonable.

112025: nonprofit brand licensing becomes taxable

Universities selling expensive hoodies must pay tax on branding income. Students will cover the difference through higher fees.

112026: research is only tax free if public

Corporate funded secret research can no longer hide inside nonprofit loopholes.

112027: keep the cap on big business losses for wealthy individuals

Rich business owners cannot use unlimited paper losses to erase their taxes. The real loopholes remain.

112028: corporations capped at one percent charitable deductions

Corporations cannot write off giant donations anymore. They will manage.

112029: punish foreign countries taxing U S companies unfairly

In simpler terms, only the United States gets the privilege of taxing its billionaires.

112030: lower tax on silencer purchases

Because nothing says family relief like cheaper gun silencers.

112031: tighten the eight hundred dollar import loophole

Foreign mega sellers dumping cheap items into the country are finally addressed. Even Amazon is pretending to approve.

112032: crack down on customs refund manipulation

Corporations stop receiving refunds for taxes they never paid. This should have happened decades ago.

Part 2: removing taxpayer benefits for illegal immigrants

(Politicians love focusing on this topic when they want to distract from billionaire perks in the same bill.)

112101: restrict ACA premium tax credits to individuals with legal status

This blocks Affordable Care Act insurance subsidies for people without lawful presence in the country.

112102: undocumented immigrants cannot receive ACA premium tax credits

This section confirms that ACA financial assistance is off limits to individuals without lawful status.

112103: no ACA subsidies during periods of Medicaid ineligibility due to immigration status

If someone loses Medicaid due to immigration status, they also lose their ACA subsidies for the same period.

112104: limit certain Medicare benefits for individuals without legal presence

Certain Medicare benefits are restricted for people who are not legally present.

112105: tax on remittances

A new tax is placed on money sent to family overseas. A struggling immigrant sending one hundred dollars to feed a parent will now be taxed.

112106: SSN required for education credits

Reasonable on its own, but mostly symbolic in this context.

Part 3: preventing fraud, waste, and abuse

(Now they suddenly care about fraud, after approving massive benefits for the wealthy.)

112201: stricter ACA Marketplace verification for premium subsidies

People applying for Affordable Care Act subsidies must go through stronger verification. This may slow down or block payments for families who actually qualify.

112202: no ACA subsidies if special enrollment was not verified

People who enter coverage through special enrollment will lose subsidies if documentation is delayed or incomplete.

112203: IRS can reclaim every dollar of excess ACA premium tax credits

If the government overpays someone’s ACA subsidy by accident, it can now take back the full amount. Corporations usually get treated more gently.

112204: Medicare must use AI to detect fraud

Fraud in Medicare is a serious issue, so this is reasonable.

112205: shut down late COVID ERC claims

Most of those late claims were scams. This is one of the few clean decisions.

112206: earned income tax credit reform

Duplicate child claims will finally be flagged. Long overdue.

112207: end IRS direct file

Congress responds to easy, free tax filing by shutting it down. Tax preparation companies who lobbied for this are thrilled.

112208: extend deadlines for Americans wrongfully detained abroad

A rare bipartisan moment of humanity.

112209: end tax exempt status for terrorist supporting nonprofits

Straightforward and necessary.

112210: bigger penalties for IRS employees leaking taxpayer info

Too much sensitive data was being leaked, especially the tax returns of wealthy individuals who often pay little to no tax.

112211: limit IRS authority over contingency fee tax prep services

Translation: do not regulate companies that lobby heavily.

Subtitle d: increase in debt limit

113001: raise the federal debt ceiling

Every time Congress approves massive tax cuts for the wealthy, the debt ceiling quietly rises afterward. And here it is again.